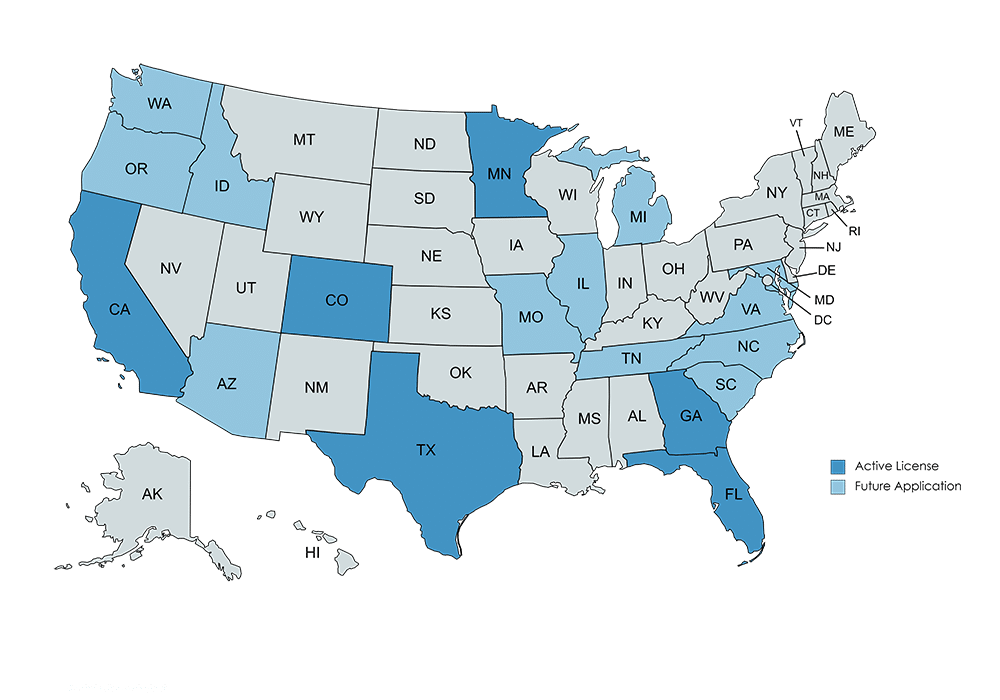

We make it easy, no matter where you are.

Menu

- Solutions

Mortgage Loan Solutions

- Team

- Partners

Our Partners

Global Home Insurance Services is a Texas Insurance Broker. We shop for the best insurance coverages and premiums so you don’t have to!Global Home Realty is a full service Brokerage firm operating throughout Texas committed to providing our clients with expert knowledge and professionalism necessary to complete one of the most significant decisions you are likely ever to make.Appraisal Management Corp offers compliant Residential Appraisal Management for the lender, Global Home Finance. We offer superior appraisal review and an independent technology platform that results in fast turn times and superior quality of reports.

- About Us

- Blog

- Careers

- Reviews